Security

Security advice

how Aion protects you and your money.

Security advice

how Aion protects you and your money.

Your safety is our key priority. Below is an overview of how Aion protects you. There is also some advice on how to use mobile and online banking safely and avoid any potential risks.

Aion takes multiple first-class measures to keep your security at the highest level:

MOBILE APP

IMPORTANT: Download the mobile application only from official stores (e.g. App Store or Google Play) and remember to keep the application up to date.

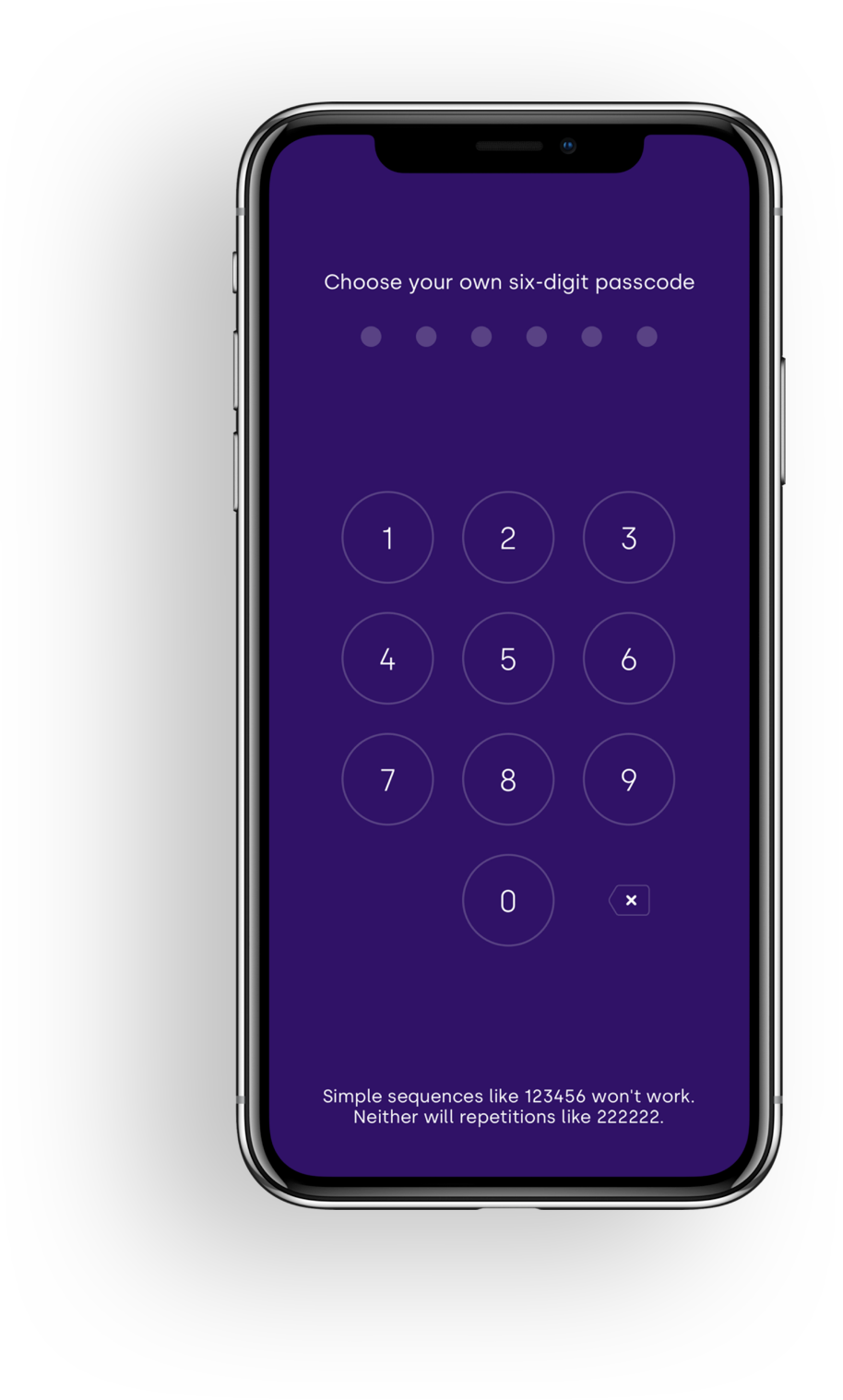

PASSCODE (APPLICATION PIN)

Your passcode is the first line of defence for the protection of your personal data. The passcode is 6 digits long. To maximise protection, your passcode should not be:

Our mobile app checks passcodes and blocks the use of simple ones.

And remember do not share your passcode with anyone!

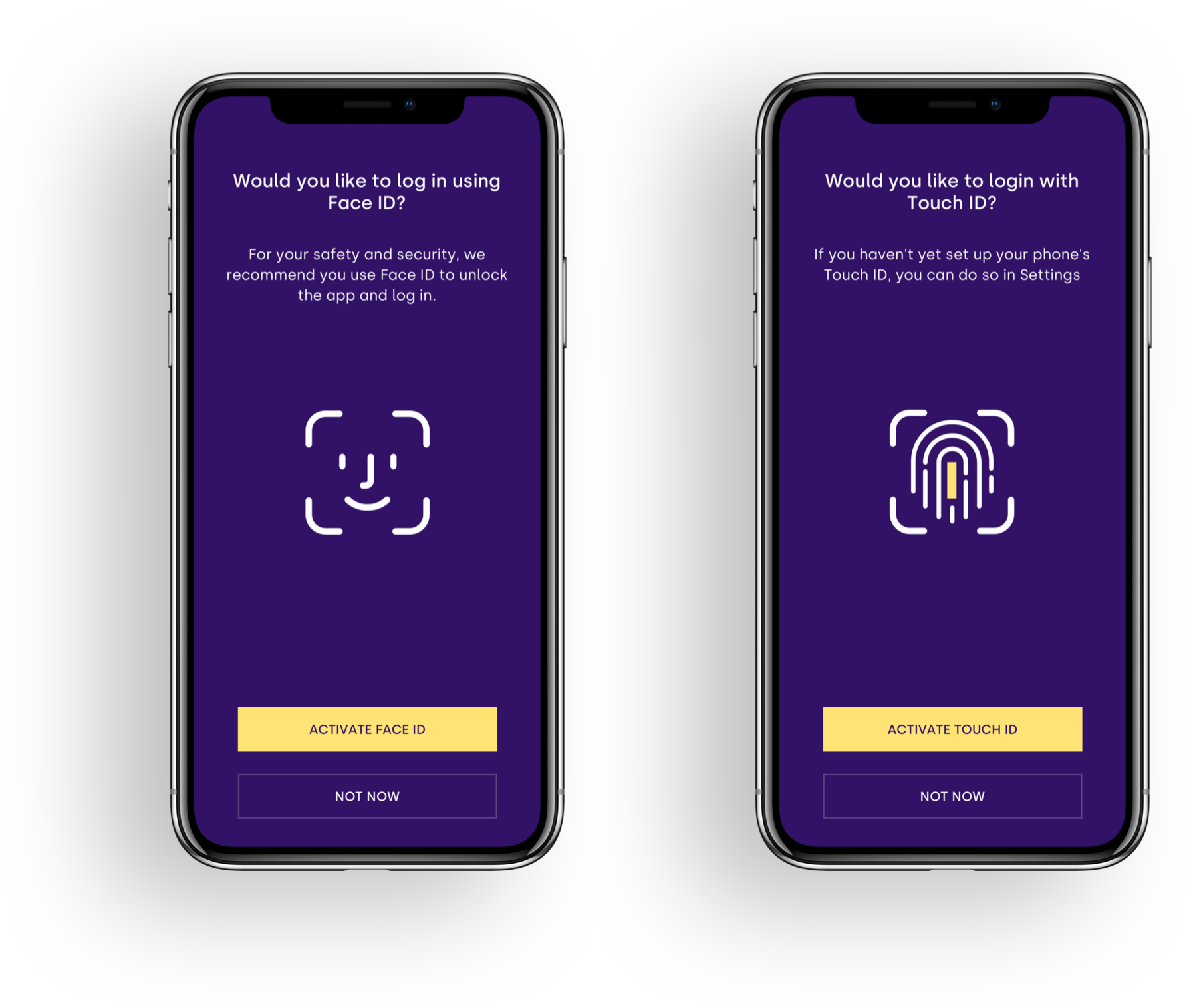

BIOMETRICS

If your mobile has Touch ID or Face ID in the case of iPhones and equivalent for Androids, you can use them instead of a passcode for login. You just need to set them up.

Your mobile app and passcode or biometrics used together constitute two factor authentication. This approach provides high security and is in line with the PSD2 Regulatory Technical Standards for strong customer authentication.

Even when you are using biometrics, we will ask you for the passcode to confirm some transactions from time to time.

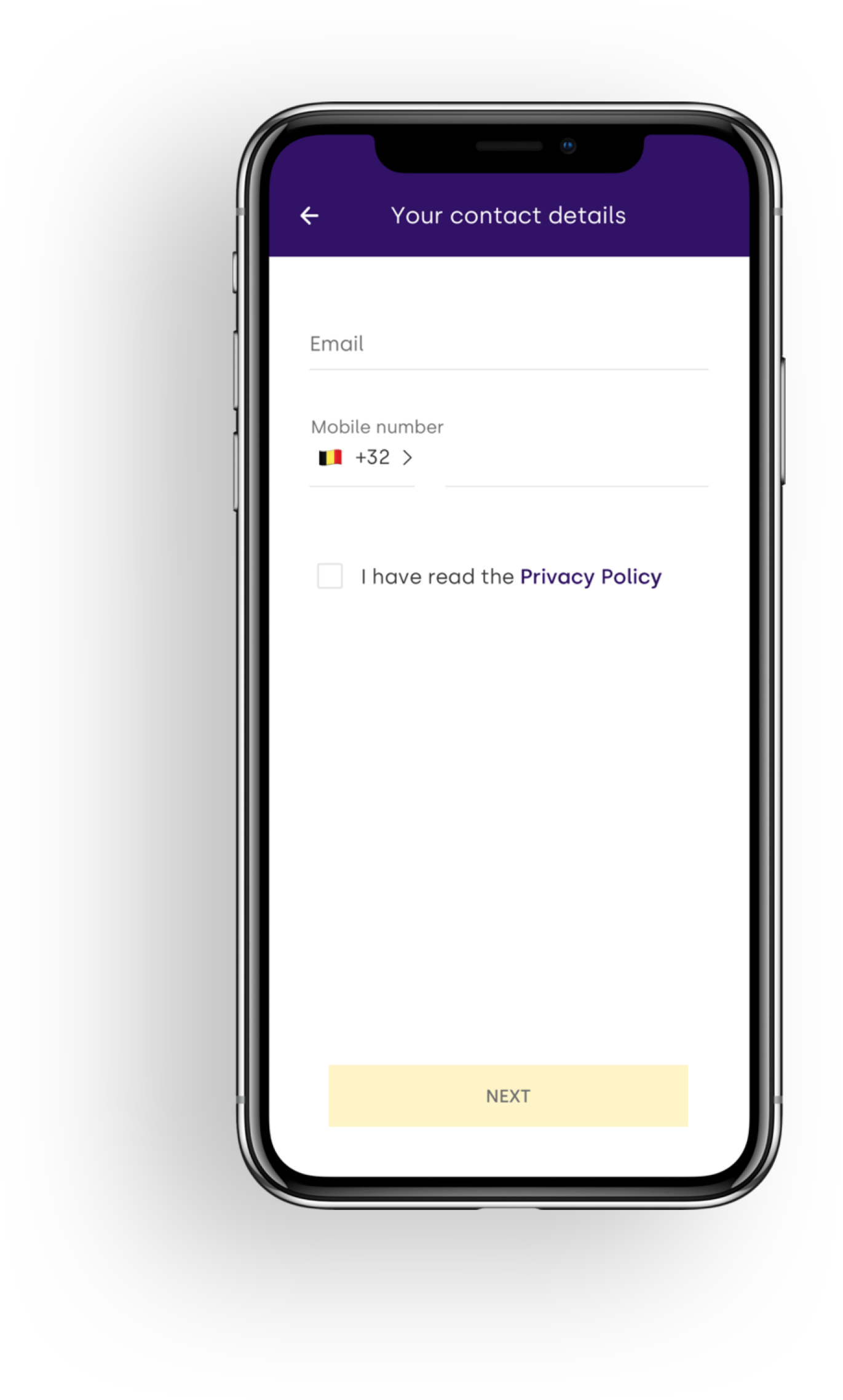

Data changes

Any change of data in your App requires additional confirmation with a passcode or a unique SMS code.

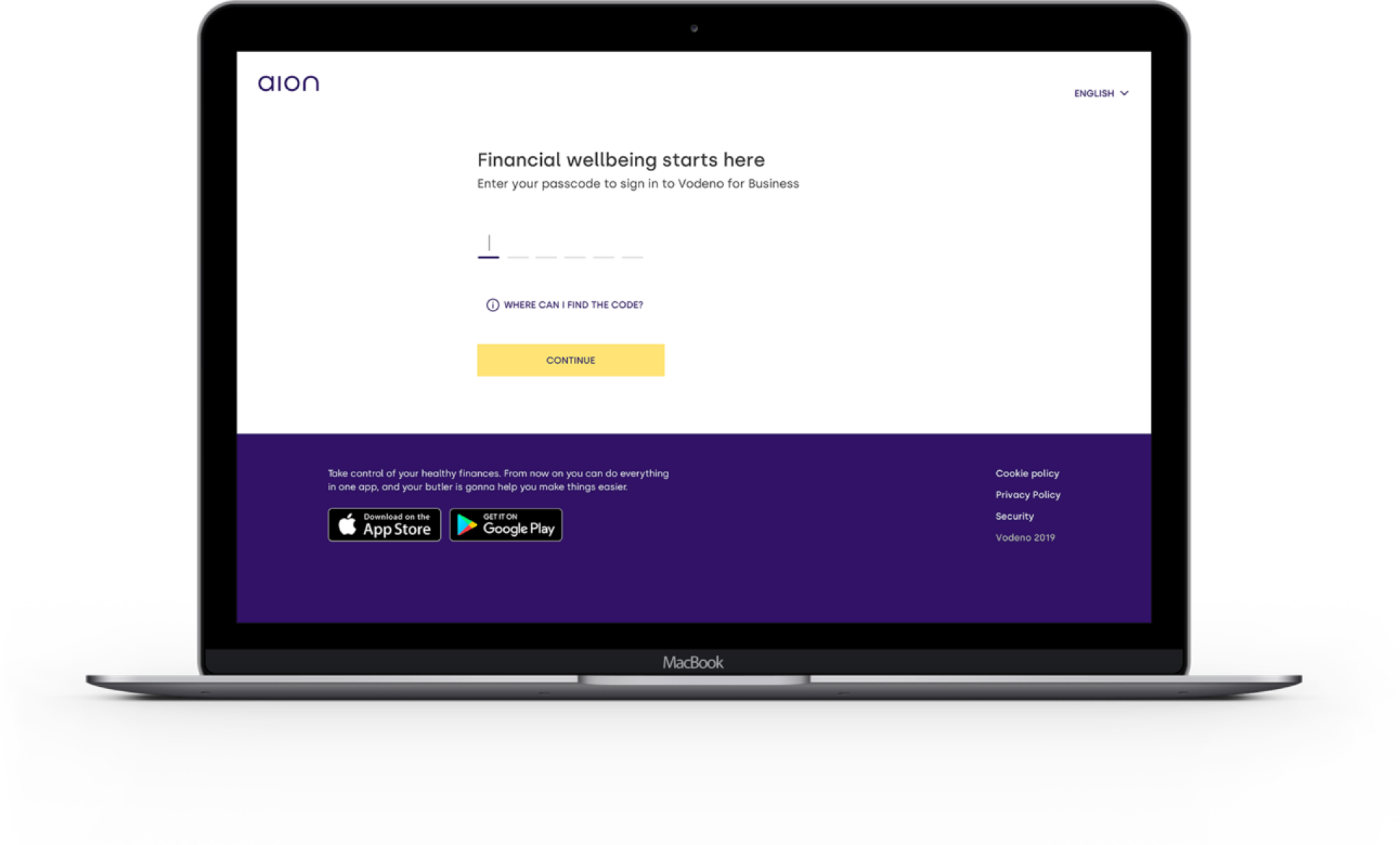

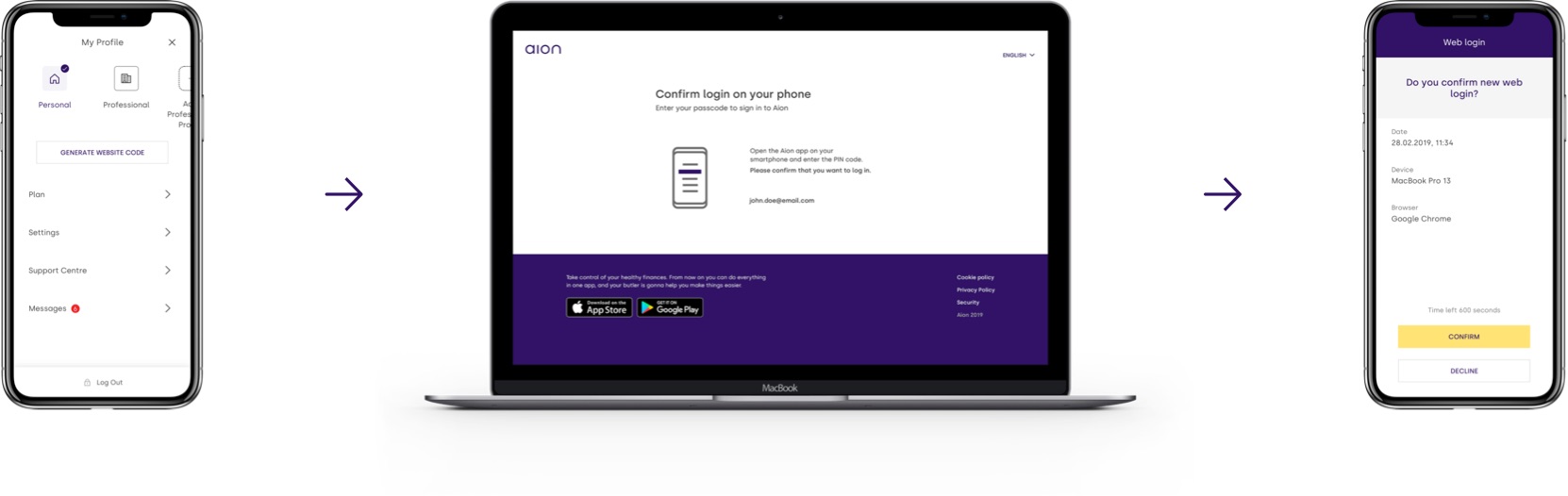

ONLINE BANKING

We enhanced security when you login to our web online banking. As you probably noticed: indeed, there is no login field. At Aion, we have a unique way to enter our online banking! To do so, a special one-time, unique 6-digit code (not an application passcode!) is required.

To get a code:

It might sound complicated, but this measure gives you yet more security.

To enter online banking, you need your two factor authentication from your mobile application. This way, website services are protected as strongly as the mobile application.

To enter online banking, you need your two factor authentication from your mobile application. This way, website services are protected as strongly as the mobile application.

PAYMENT CARDS CUSTOMISED SECURITY SETTINGS

You can customise your Aion Mastercard permissions and restrictions. With a few taps, you can:

All online card transactions are protected by 3D Secure.

TRANSFERS

Every time you make a money transfer to a new recipient, they need to be added to your trusted recipients contact list. To do so, you need to confirm it with a passcode. It is an extra security feature to better protect you.

ADDING TRUSTED RECIPIENT FOR TRANSFERS

To add trusted recipient:

From your home screen, pick “Transfers”

From now on, transfers to that recipient won’t require further authorisation (except when we suspect a fraudulent transaction).

Real-Time account notifications

You will receive instant push notifications after all account activity, so you always know where your money is going and when. You don’t need to wait a few days to see a transaction, or until the end of a billing period to see all your transactions.

Security advice

To further enhance security, please follow these guidelines:

MOBILE SECURITY

We recommend that you regularly update the software on your smartphone. Manufacturers frequently issue software updates to protect against new safety defects.

Make sure you download banking apps, and any other apps, only from the official manufacturers’ stores (such as the App Store or Play Store). Be suspicious of any new unfamiliar apps. They can contain malware and facilitate access to your sensitive details.

We recommend that you disable publicly accessible Wi-Fi connections and your device’s Bluetooth function before you make a mobile connection to your bank. Even if you are using a private Wi-Fi network, you should check that it is secured by the WPA2 system.

Avoid using jailbreak/rooting. Use built-in security features of mobile phones (e.g. Find My iPhone/Android Device Manager). Set up alphanumeric passphrases to protect access to your mobile phone.

PC SECURITY

The safety of your PC/laptop is very important because you may visit websites where personal data can be intercepted.

An unwanted download of a virus, a Trojan horse or a keylogger are some ways to obtain sensitive information like your login and password. Afterwards, it can be used to login with your name on websites of banks, stores and many others.

There are different ways to protect yourself against these forms of attacks:

Do not download any software onto your computer from suspicious or illegal websites, as you are likely to simultaneously download a virus or other form of malware.

Only use software that has been purchased from trusted sources. Illegal software sometimes contains hidden features which allow your computer to be used remotely for illicit dealings on the Internet.

To prevent any risk of fraud, you are advised to:

Email is used more and more often by users at home as well as in professional life because it is an easy and fast way to communicate. This increased use has not escaped the attention of people with bad intentions and they do not hesitate to use it to flood you with advertisements (spam), refer you to sites that trace your personal data (phishing) or install a virus from a document in an attachment.

Some good habits to escape from such messages:

THE BROWSER

A Browser is a program (e.g. Explorer, Safari, Chrome, Firefox) that enables you to visit websites.

Make sure you always have an up-to-date version of your web browser.

To make surfing the Internet easier, some pieces of information can be saved on your PC (cookies, web history and information forms). It is recommended to delete this information on a regular basis (please refer to the help provided by your Browser).

Please bear in mind that your bank will never ask you for a password or login, so do not disclose personal data in emails.

The e-Banking site of the Bank has a certificate which enables visitors to verify the site identity. Certificates are subject to very strict criteria and issued after comprehensive identity checks.

PHISHING

Phishing is an important form of Internet fraud. The aim of phishing is to gather your personal and secret data. Phishing can take several forms: by email, via a pop-up, via your favourites (altering one of your favourite links, so that you are redirected to another site) or even by telephone. Do not be tricked into opening an email that appears to be from a company that you know and asks you to click a link to provide your personal details for the purpose of updating or controlling files!

Aion will never contact its clients to ask them for their bank details (e.g. payment card number, PIN code of your card, Becoming Aion identifier, Passcode, unique codes for website, etc.).

Any clients who receive such a request should be aware that they are dealing with fraudsters and must not respond under any circumstances. Have you received a suspicious email claiming to be from Aion?

PAUSING CARDS BY SMS CODE

In case of losing your cards and personal belongings, you can pause your card by sending SMS code to:

+491771782272

Please follow the instruction to pause one card:

[your mobile phone number which you are using for contacting us] [your date of birth using the format yyyy-mm-dd] [last four digits of your card]

example:

+3212345678 1980-01-01 1234

Please follow the instruction to pause all cards:

[your mobile phone number which you are using for contacting us] [your date of birth using the format yyyy-mm-dd]

example:

+3212345678 1980-01-01